News flash: There is no reason to panic

We all know that Bitcoin’s price was appreciating at a mind-blowing rate the last few years. Reaching an all-time high of almost $65,000 back in April! Colleagues and friends are prophesying that the price of BTC might even surpass $100,000 soon. If that is the case, then why did the price of Bitcoin diminish so rapidly? Is there a reason to panic? Absolutely not. There is more going on behind the scenes of the crypto market.

Let’s look at the crypto market. To fully understand the actual causes of the recent dip of almost all crypto assets, we must realize why it appreciated so rapidly in the first place. The massive Bitcoin bull run, and the altcoin market as well, was primarily caused by large instructional investments. But do these guys even know what these assets really are? More likely than not, the answer is no. Pumping the market for immediate gain is not sustainable.

Many of these institutions were and still are getting into the market without a real and complete understanding of cryptocurrency. The little they do know is mostly based on mainstream news and the talk around town. As the exposure and buzz around crypto continued to build, new players in the crypto space were jumping at the chance to get to the next level.

Crypto beginners who were positioning themselves as experts in the space have been quiet since the market slipped. Aside from Microstrategy, who recently put 400 million more into BTC, most people have gone into hiding, or worse they’ve decided to ride the bandwagon of market manipulation and push the market down even further. Maybe these companies are doing this so that they can buy more crypto. This leaves current investors in a vulnerable position, and some even start panic selling.

Not to mention, the inefficiencies and environmental concerns of Bitcoin were always there, so why is everyone suddenly reacting to this now?

Who can you trust? The mainstream media anchor on your local 5pm news station? Elon Musk? Some guy you just met via Twitter? Pretty sure that the sources providing most of the world’s population with information on blockchain technology and cryptocurrencies likely have no idea what they are even talking about.

Here’s the deal. Educating the market is just as important as making money in the crypto market.

So, what is “crypto”, really?

By now, you’ve heard of Bitcoin. Great, so you understand the grandfather of cryptocurrency. But have you heard of Ethereum? Litecoin? Stellar Lumens? Etc.? Countless other altcoins are out there, but that is not what the crypto market is all about. As I’ve shared before, the most commonly bought coin does not equal the best coin.

The crypto market is far from monolithic. Fully decentralized cryptocurrencies like Bitcoin coexist with centralized, corporate-owned tokens like Ripple. Investing in the traditional stock market shares a similar experience. Newcomers don’t know what to do, so they put their money in the S&P 500. Why? Because they are taught that is the safe bet. However, those who are willing to put in the time and their own research will be able to make better, informed decisions and diversify. This is exactly what is happening in crypto right now.

So, let’s talk about ongoing projects and their importance to our entire ecosystem.

Ethereum projects have thousands of active developers every month and are mentioned in the same sentence with meme coins like DOGE, which have no developers. Ethereum is currently undergoing multiple upgrades, which will unlock the currency’s full potential with better speed, efficiency, scalability, and security. This is drawing more eyes to Ethereum, including investors who are looking to diversify their cryptocurrency portfolios.

Simply put, there’s really not too much in common between quality crypto projects built on solid technologic fundamentals and thousands of low-effort tokens with no real-life use cases. Instead, we should be focusing our attention on other factors, like DeFi protocols. Even some of the top DeFi protocols will remain unknown to newcomers. If some of these are more scalable and useful than Ethereum, how come their potential is not in the spotlight? Why are even exchanges afraid of DeFi and not highlighting its potential? It is because they do not want their power taken away. They do not want people to pull their resources to get the best result. They’d rather you lean on their exchange, even when outages happen frequently.

Taking it back to the dip in the market – This is a good thing and let me explain why.

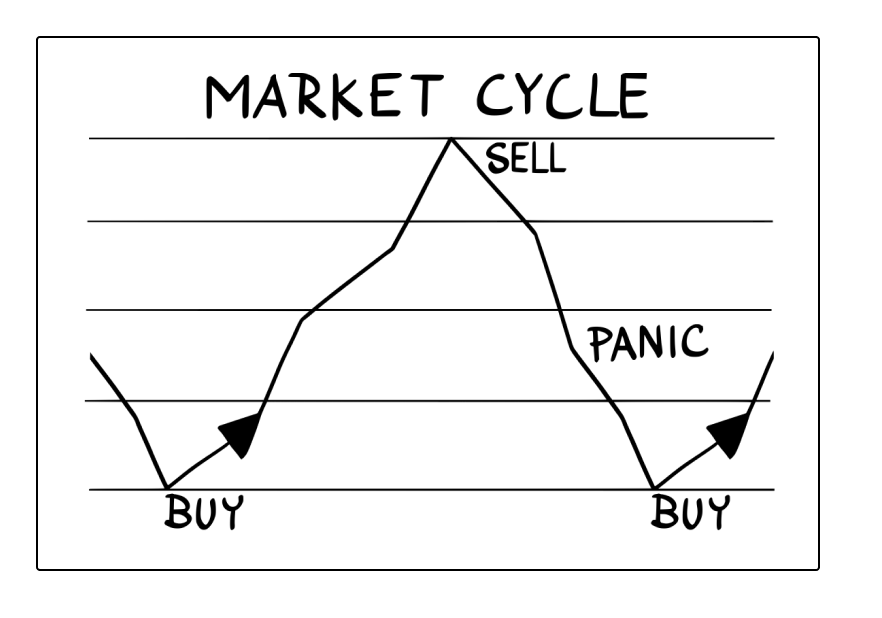

The cycles of the crypto ecosystem are easy to identify, and they haven’t changed in years. First, the Bitcoin price rapidly goes up. Then, retail investors start to think that BTC is “too expensive”, and they begin to invest in new offerings such as DeFi or NFTs which helps to educate and inform retail investors about other new opportunities.

However, just like any investment or decision you make, you need to conduct your due diligence. Coins such as DOGE will naturally disappear, not because of a market crash but because there is not enough education behind it. Many are buying in on the hype because they hear it on the news or even through memes seen online. They have not actually done any research on the coin itself. Same for Bitcoin, no one is questioning anything or taking their time to actually learn about what is going on, it’s all about the hype.

We want to educate YOU.

On the free market, price discovery is an ongoing and never-ending process in which all the actors try to predict the real value of the items they are buying or selling.

When it comes to the true value of quality cryptocurrencies like Bitcoin, is our future digital currency? Is this what users want? A new world of a digital internet of things ecosystem, it sure does have its advantages.

The true solution here is all about better education. There are not enough people who know what’s really happening behind the scenes of crypto. More investors and players need to question authoritative figures and powerful news outlets. When was the last time you got rich after reading an article in the daily mail? It’s never that easy. Everyone has a motive, and since this industry is still so new, we all need to put on our investigative hats, and dig deeper.

In my next piece, I’ll look to discuss the differences between centralized versus decentralized powers. We will dive into the matter of why centralized powers are afraid of DeFi. Right now, there is a lot of focus on how traditional banking and government are reacting to cryptocurrency. People are used to looking to these large institutions and government bodies for guidance, however, they are not the experts when it comes to cryptocurrency.